-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To Transact

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

-

Link to ODR

- Back

-

Shareholders

Invest in India's Defence Sector with a Passive Index Fund – As India aims to strengthens its defence capabilities, you can too aim to fortify your portfolio!

-

What it is?

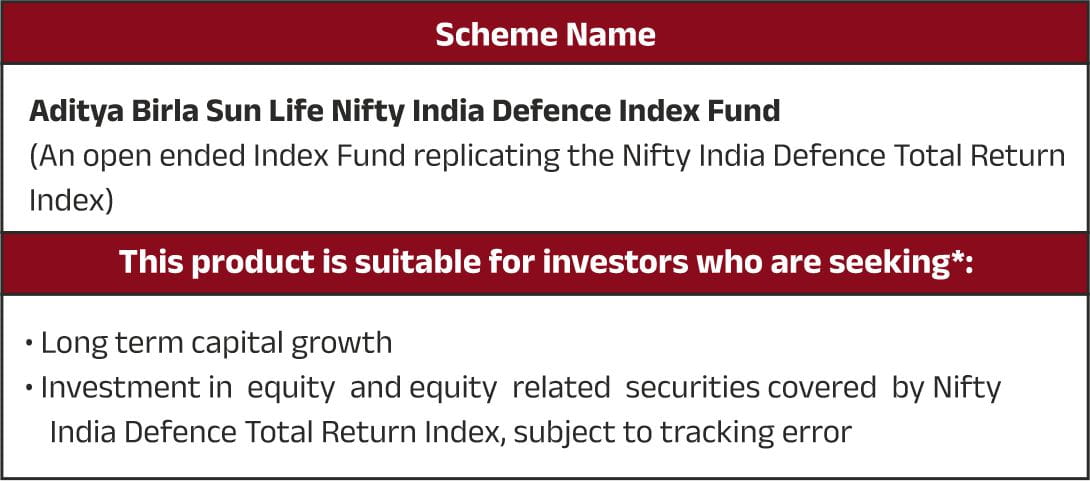

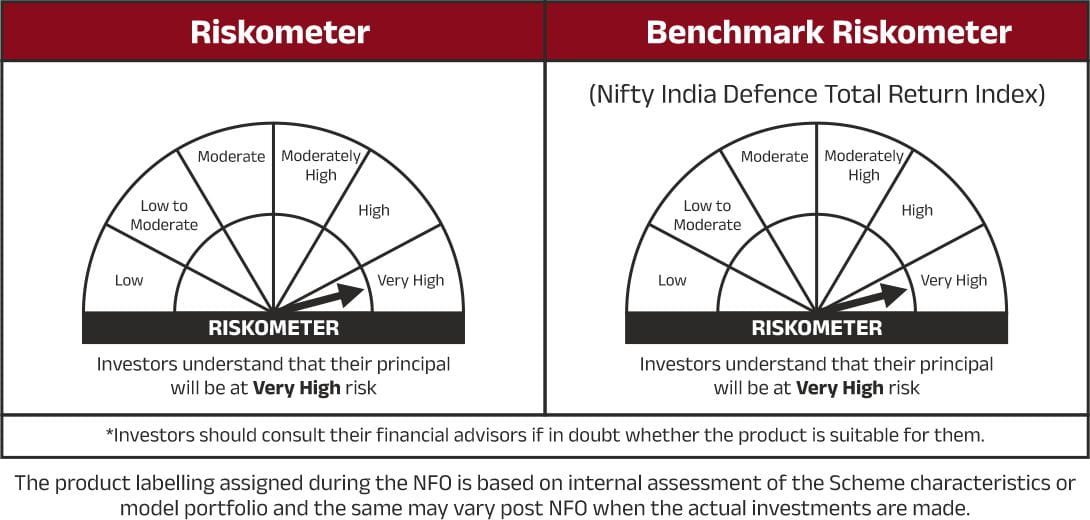

An open-ended Index Fund replicating the Nifty India Defence Total Return Index. -

Investment Objective

To provide returns that, before expenses, correspond to the total returns of securities as represented by the Nifty India Defence Total Return Index, subject to tracking errors. The Scheme does not guarantee/indicate any returns. There is no assurance or guarantee that the investment objective of the Scheme will be achieved. - Minimum Application Amount

Lumpsum: Minimum of Rs.500/- and in multiples of Rs. 100/- thereafter.

Monthly / Weekly Systematic Investment Plan (SIP): Minimum of Rs. 500/- and in multiples of Re. 1/- thereafter

- Index Construction

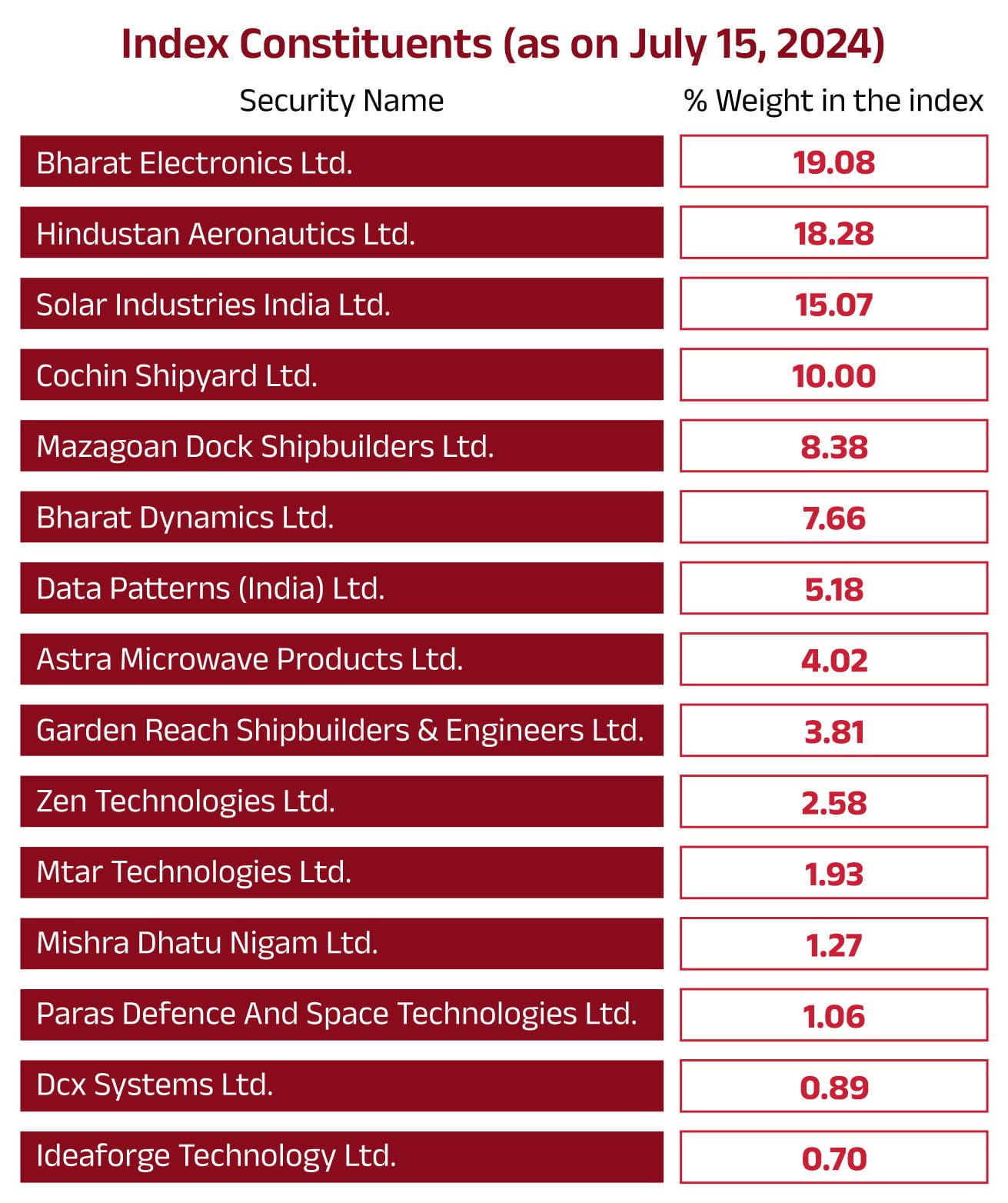

The scheme invests a minimum of 95% in equity constituting the Nifty India Defence Index. The constituents of the Index are selected from the universe of the 750 Nifty Total Market Index. A minimum of 10 stocks are selected that are present in the Society of Indian Defence Manufacturers and who obtain at least 10% of revenues from the defence index. The weighting of stocks will be based on free float market capitalization. There is a stock capping of 30 stocks and no single stock shall have a weight of more than 20%. Please refer to the SID for further detailed methodology. - Key Feature

A passive investing strategy, that tracks defence stocks through a market cap-based Defence index, aimed at generating long term capital gain from a high potential defence sector

Why should you invest in Aditya Birla Sun Life Nifty India Defence Index Fund?

For more information on the scheme, please refer to SID/KIM of the scheme.

Sources:

1. Targets set by Union Defence Minister – February, 2024

Sources:

1. Targets set by Union Defence Minister – February, 2024

1800-270-7000

1800-270-7000