-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To Transact

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

-

Link to ODR

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Declaration

The information and data contained in this Website do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any Schemes/Units of Aditya Birla Sun Life Mutual Fund (ABSLMF), securities or financial instruments in any jurisdiction in which such distribution, sale or offer is not authorised. In particular, the information herein is not for distribution and does not constitute an offer to buy or sell or the solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and Canada to or for the benefit of United States persons (being persons resident in the US, corporations, partnerships or other entities created or organised in or under the laws of the US or any person falling within the definition of the term "US Person" under the US Securities Act of 1933, as amended) and persons of Canada.

By entering this Website or accessing any data contained in this Website, I/We hereby confirm that I/We am/are not a U.S. person, within the definition of the term 'US Person' under the US Securities laws/resident of Canada. I/We hereby confirm that I/We are not giving a false confirmation and/or disguising my/our country of residence. I/We confirm that Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited (ABSLAMC) is relying upon this confirmation and in no event shall the directors, officers, employees, trustees, agents of ABSLAMC associate/group companies be liable for any direct, indirect, incidental or consequential damages arising out of false confirmation provided.

An ETF to access the investment opportunity presented by G-secs – current elevated yields, potential capital gains and security of sovereign rated instruments.

-

Macro-economic stability brings with it a fixed income opportunity

With low core inflation, attractive real interest rates, a stable currency, and a reducing fiscal deficit, the current macro-economic environment makes fixed income investments appealing. -

Indian G-secs going global!

Indian G-secs have been included in JPMorgan's GBI-EM Global Diversified Index, leading to an increase in FII inflows into FAR securities. Inclusion in the Bloomberg Global Aggregate Index may further boost demand for Indian G-secs.

FAR: Fully Accessible Route -

Rising Demand Enhances Capital Gain Potential

A fall in yields from current elevated levels can result from increase in global demand. Additionally, fiscal consolidation and reduced borrowing can lead to a demand-supply imbalance, enhancing capital gain prospects. -

Capitalise on G-sec opportunity today

Current high yields present an opportunity for higher accrual benefit. Additionally, the capital gain potential and sovereign rating of G-secs make it an attractive fixed income investment avenue today. -

ETF route to access G-secs

The G-sec yield curve is elevated at the 10-year point. The CRISIL 10-Year Gilt Index tracks the performance of on-the-run benchmark 10-Year G-sec. By tracking the most recently issued and actively traded G-sec, this index can potentially enhance investor gains.

An ETF tracking the CRISIL 10-Year Gilt Index offers a passive, efficient way to benefit from current G-sec opportunities, providing ease of trading, low minimums, and high liquidity.

What are G secs and why invest in them?

G-secs are securities issued by the RBI on behalf of the Government of India. They serve as an acknowledgment of money borrowed by the Government, with coupon payments and repayment guaranteed by the central government, giving them a sovereign rating.

Being sovereign rated debt instruments, G-secs carry negligible credit risk.

Increased global demand coupled with decreased supply of G-secs can create a demand-supply imbalance. This situation presents an opportunity for capital gains from G-sec investments.

Index Constituent (as on July 31, 2024)

Security Name |

Weight |

Maturity Date |

|---|---|---|

7.10% GS 2034 |

100% |

08 April 2034 |

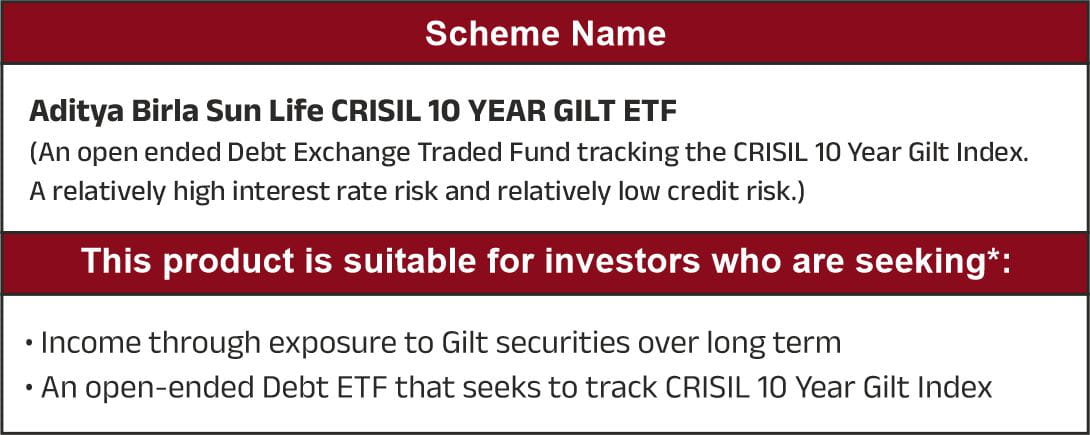

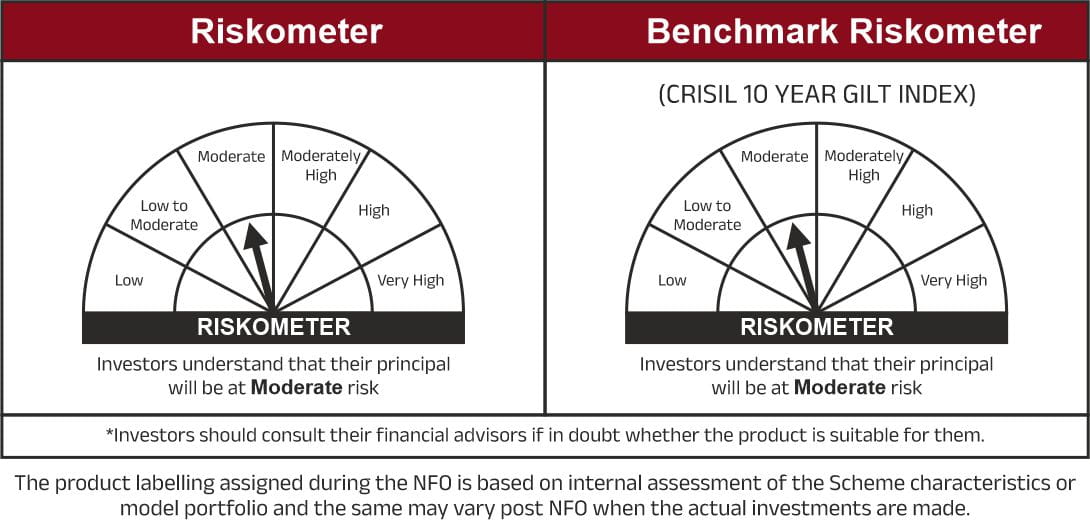

Aditya Birla Sun Life CRISIL 10 Year Gilt ETF

Download

For more information on the scheme, please refer to SID/KIM of the scheme.

For Index methodology & constituents, please visit: https://www.crisil.com/content/dam/crisil/Indian-Consolidated-Factsheet/2024/CRISIL%20Indices%20Factsheet%2015%20July%202024.pdf

Note: Please go through the Scheme Information Document to understand the investment objective, asset allocation, risk factors associated with the Scheme before investing.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

This document represents the views of Aditya Birla Sun Life AMC Limited and must not be taken as the basis for an investment decision.

1800-270-7000

1800-270-7000