-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

-

SWP Calculators

-

Link to ODR

- Back

-

Shareholders

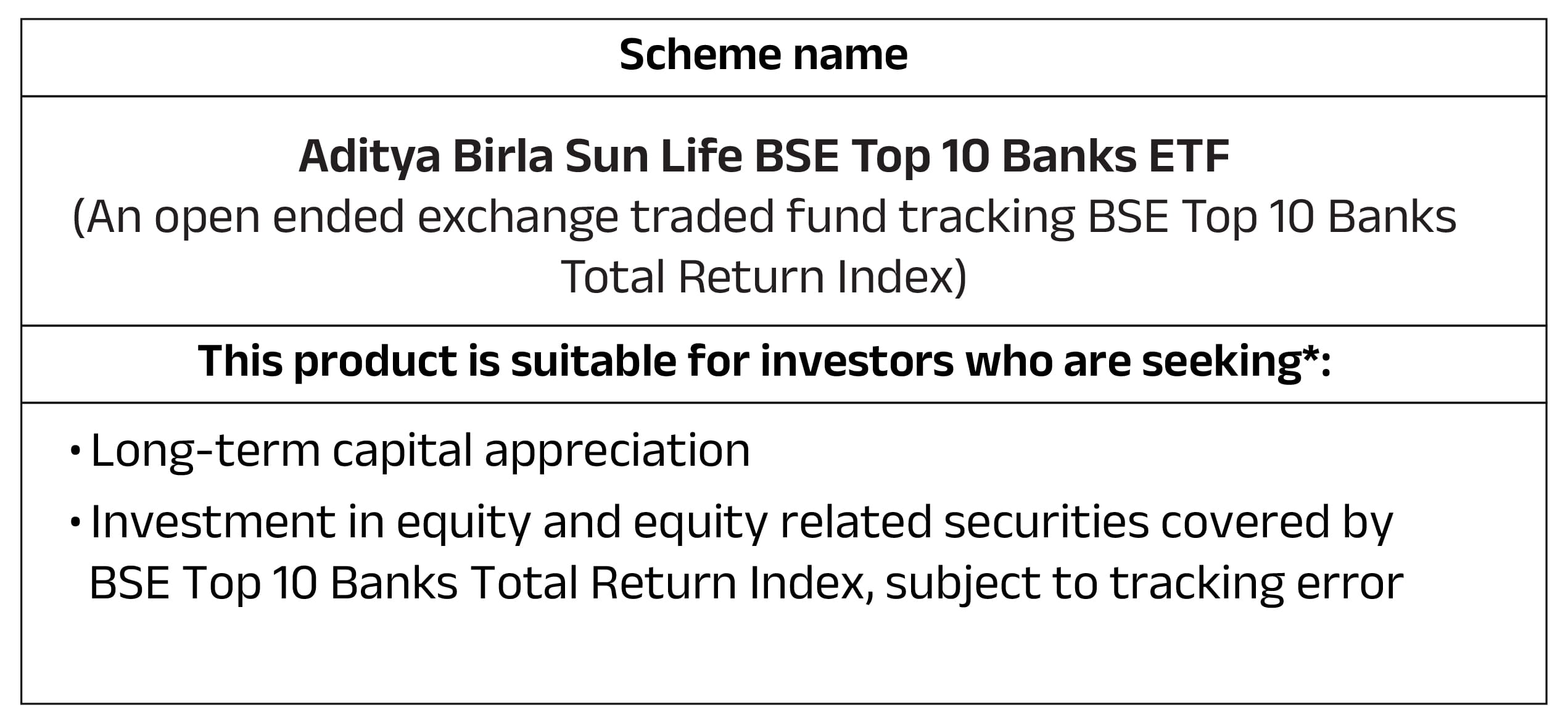

Focused Exposure to India’s Banking Leaders

Invest in India’s top 10 largest private and public sector banks through an ETF designed to provide disciplined, transparent exposure to the core of India’s financial system.

Banking at the core of India’s economy

Banks account for over 60% of India’s financial system assets and play a key role in the nation’s progress. As credit penetration rises and financial knowledge gains popularity, the sector will continue gaining prominence as a key pillar for exponential growth.

-

Strengthening Fundamentals

Over the past decade, banking activity has strengthened in India with earnings as well as domestic deposits & credits tripling. In CY25, banks closed the year with their strongest balance sheets in over a decade, characterised by stable asset quality, record-high capital buffers, and historically low non-performing assets

-

Top performing sector

Banking indices have shown greater resilience during economic tensions and stronger performances during recovery phases vs broad based indices. In CY25, the sector delivered returns of ~18%, cementing its position as one of the best performing sectors

-

Better suitability for broad market replication

Revised SEBI F&O eligibility norms have introduced additional eligibility criteria for indices trading on the futures & options segment of stock exchanges. To be compliant with the updated regulations, current banking indices are expected to undergo structural changes in a phased manner. These changes are expected to increase stock level dispersions of the index against broad based market cap weighted indices materially, making them less suitable for broad market replication. The BSE Top 10 Banks Index does not focus on the updated regulations thereby providing investors with a convenient solution for long term broad market replication

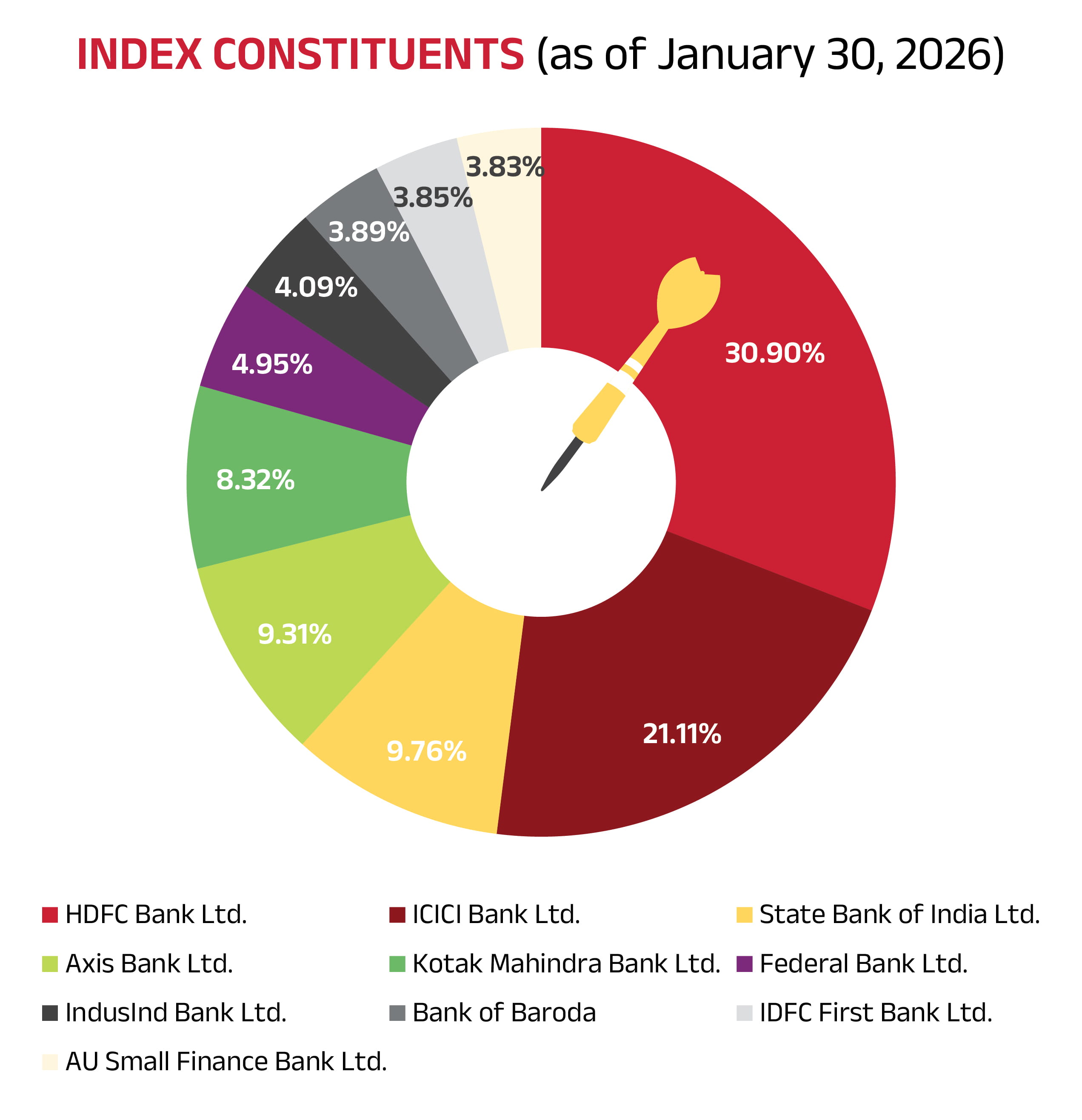

About the BSE Top 10 Banks Index

The index comprises the top 10 largest private and public banks from the BSE 500 universe, selected based on average six-month free-float market capitalisation.

Index methodology https://www.bseindices.com/Downloads/BSE_Indices_Methodology.pdf

Source https://www.bseindices.com/Downloads/Factsheet/Factsheet_BSETop10Banks_Jan2026.pdf

BSE Disclaimer: All information presented prior to the index launch date is back-tested. Backtested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not a guarantee of future results. Asia Index Private Limited 2024. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without written permission. The BSE Indices (the "Indices") are published by Asia Index Private Limited ("AIPL"), which is a subsidiary company owned by BSE Limited ("BSE"). BSE and SENSEX® are registered trademarks of BSE. These trademarks have been licensed to AIPL. AIPL, BSE or their respective affiliates(collectively "AIPL Companies") make no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and AIPL Companies shall have no liability for any errors, omissions, or interruptions of any index or the data included therein. Past performance of an index is not an indication of future results. This document does not constitute an offer of any services. All information provided by AIPL Companies is general in nature and not tailored to the needs of any person , entity or group of persons. It is not possible to invest directly in an index. AIPL Companies may receive compensation in connection with licensing its indices to third parties. Exposure to an asset class represented by an index is available through investable instruments offered by third parties that are based on that index. AIPL Companies do not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that seeks to provide an investment return based on the performance of any index. AIPL is not an investment advisor, and the AIPL Companies make no representation regarding the advisability of investing in any such investment fund or other investment vehicle.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

For more information on the scheme, please refer to SID/KIM of the scheme.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000